Taxes and fiscalization

When creating a new product, the program needs to understand what tax rate this product will be sold at. Therefore, before laying out the goods, it is necessary to set the Tax Rate Group and configure all Tax Rates in the reference section:

- Click on the button Tax Rates + in the Tax Rates window.

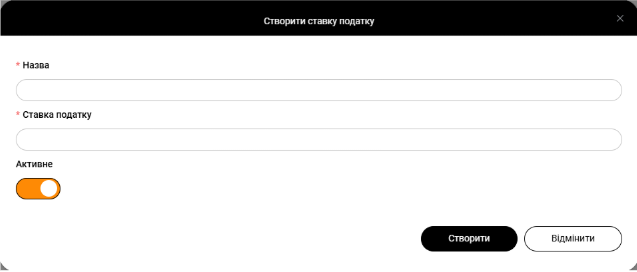

- Then you need to click on the button New Tax Rate + and fill in the following fields: Tax Rate Name (for example A, B, C, etc.), Tax Rate.If the switch in the Activity row is orange, it means that the option (service, product, etc.) is active. When pressed, the switch will turn grey and the option will no longer be active. Be sure to save any changes.

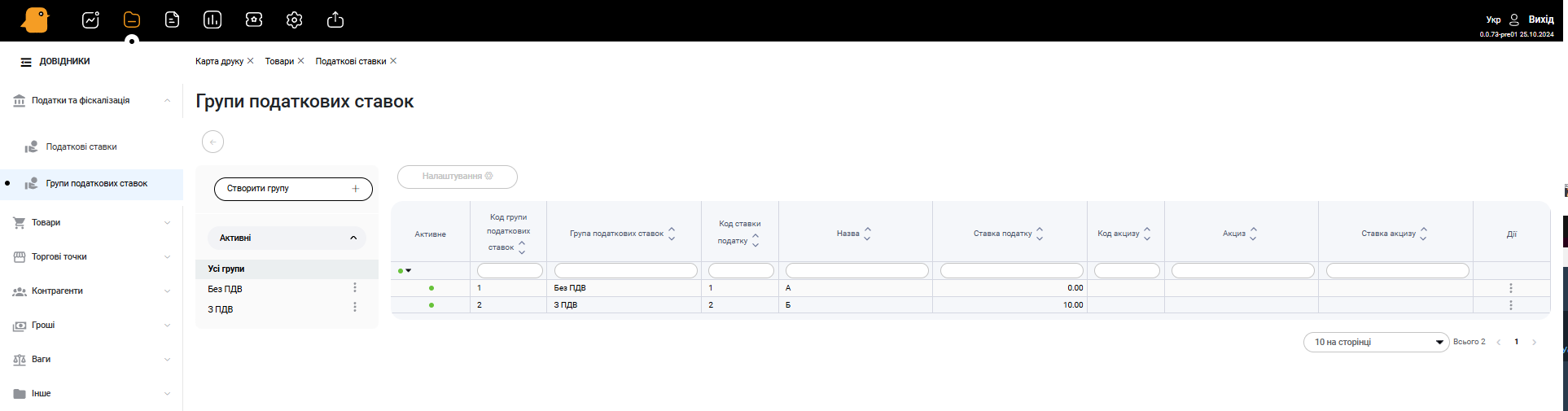

- Click on the button Tax Rate Groups in the Tax Rates window.We recommend using standard tax rate groups.

- Then click on the button New Tax Rate Group +. In the window, enter the name of the tax group (for example Without VAT, VAT VAT+Excise, etc.), assign the appropriate tax rate and click on the Create button.